The ICO industry has gone from enthusiasm to maturity. Behind each abbreviation, ICO (initial coin offering), are real stories: some projects have become flagships of the entire crypto market, while others are a warning to future investors. To understand what an ICO in cryptocurrency is in practice, it is worth looking at examples from different years: both those that have radically changed Web3 and those that have turned into high-profile failures. In this guide for beginners, we will analyze the ICO meaning in cryptocurrency, how such campaigns work, what risks and benefits they carry, and when it is worth taking a closer look at proven options like Nexchain.

ICO Meaning in Cryptocurrency: What Does ICO Stand For?

The abbreviation ICO stands for Initial Coin Offering. This is a fundraising format in which the creators of a crypto project issue their own token and sell it to investors. Unlike an IPO, where you receive shares in a company, in the case of an ICO, you receive a digital token, often with functionality within the network, for example, for access to services, voting, participation in management, or staking.

Emerged at the peak of crypto ICO investing in 2013-2014, this method turned out to be revolutionary: it allowed the community to finance experiments with blockchain and distributed applications from all over the world. Thus, the phenomenon of organized crowdfunding campaigns was born in the complete absence of traditional banking structures and regulatory oversight.

How Do ICOs Work in Crypto?

To understand how do initial coin offerings work, you should consider the main stages of preparing and launching an ICO. This process begins long before the token enters the market and requires transparency, a clear plan, and active interaction with the community.

The ICO cryptocurrency itself operates based on blockchain technologies - Ethereum, Binance Smart Chain, Solana, and others. This ensures decentralization, transparency of operations, and control over the supply of tokens. Below are the main steps that most initial coin offerings go through:

- Whitepaper. A document describing the idea, token use cases, technical architecture, release parameters, team, and development routes. It defines what is an ICO in crypto and why the project is launching tokens;

- Presale/Pre-ICO. Sometimes, a preliminary sale of tokens is held at reduced prices. This is an important stage for forming a community and receiving the first funds;

- Token Generation Event. TGE is the release and technical implementation of tokens through a smart contract. Distribution of tokens begins, often according to a specified model;

- Listing and open market. After TGE, the token is placed on exchanges, and investors get the opportunity to trade, exchange, or use the token in the service.

Who participates?

- Developers: create the project, write the whitepaper, issue a smart contract;

- Investors: private or institutional – finance the project and receive tokens;

- Exchanges: can organize an IEO, but often join after the ICO to ensure liquidity;

- Communities and validators: participate in tests, support, and vote within the DAO.

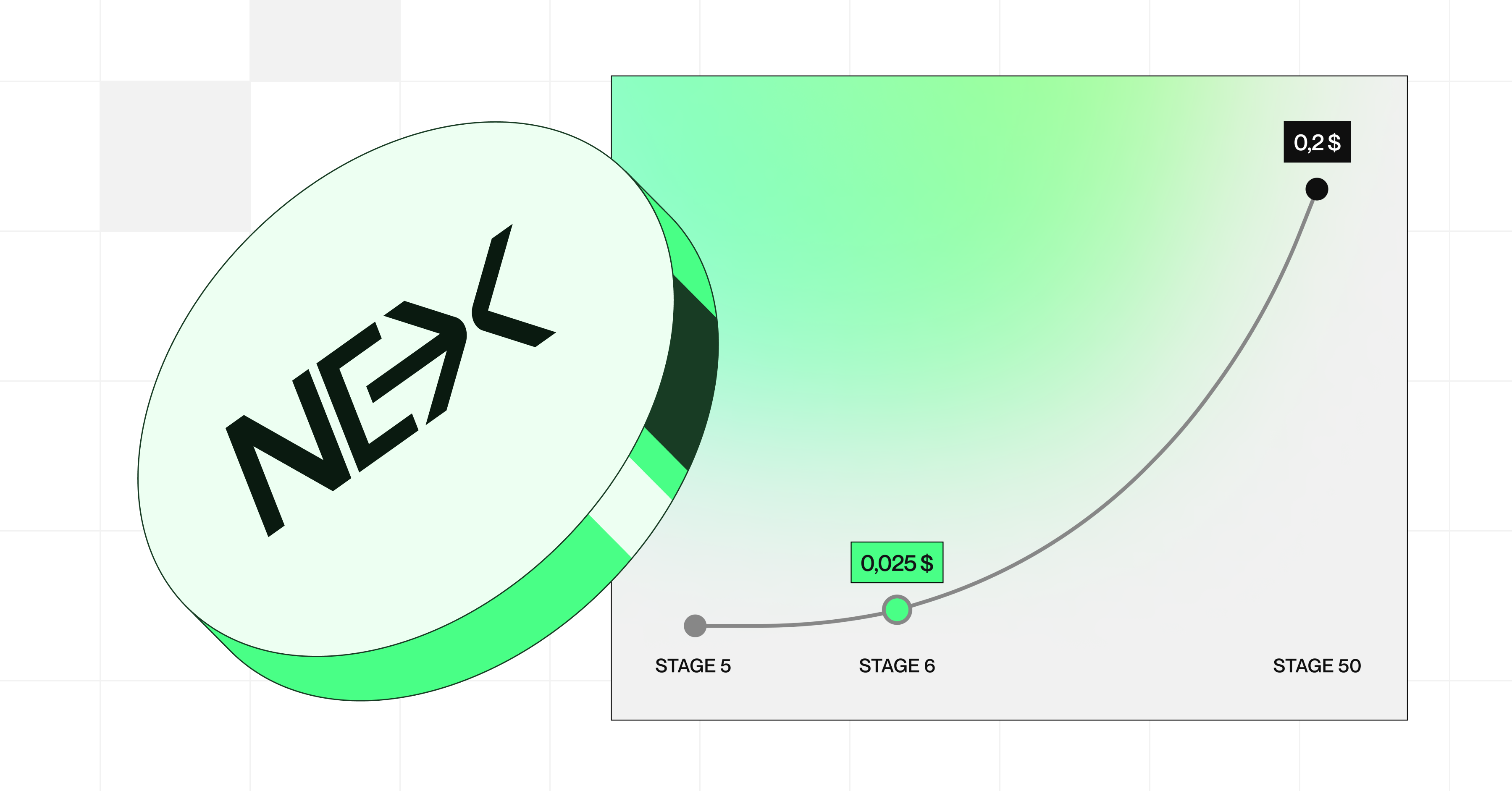

If you want to invest in a crypto ICO with a transparent platform, AI support, and a ready-made ecosystem – Nexchain is what you are looking for!

Benefits and Risks of Investing in an ICO

Many newbies ask themselves: What are initial coin offerings, and is it worth investing in them? To make an informed decision, you need to evaluate both the possible benefits and risks. Below are the advantages that have made ICO investing popular, as well as the pitfalls that are often forgotten.

Why do people choose ICOs?

- Speed and accessibility. ICOs allow you to quickly raise funds without legal barriers;

- Early access. An advantage for investors that allows them to enter at the start, when the token price is lowest;

- Decentralization. Participation in ICOs reflects a crowdfunding or DAO approach rather than a narrowly centralized investment procedure.

But not without pitfalls

- Industry scams. Among ICO offerings, there are both real projects and fraudulent schemes where investors lose money;

- Legal uncertainty. In some jurisdictions, ICOs are regulated as securities;

- Lack of control. The absence of a clear structure, a fiduciary, and a full check - all these factors increase the risks for the investor.

ICO Examples in the Crypto World

What is ICO coin, if not an opportunity to look at history: over the past ten years, the market has gone from experiments to billion-dollar token sales. To better understand the potential and risks of initial coin offerings, let's look at several high-profile cases. Some became the foundation of the industry, others - an example of how not to launch projects.

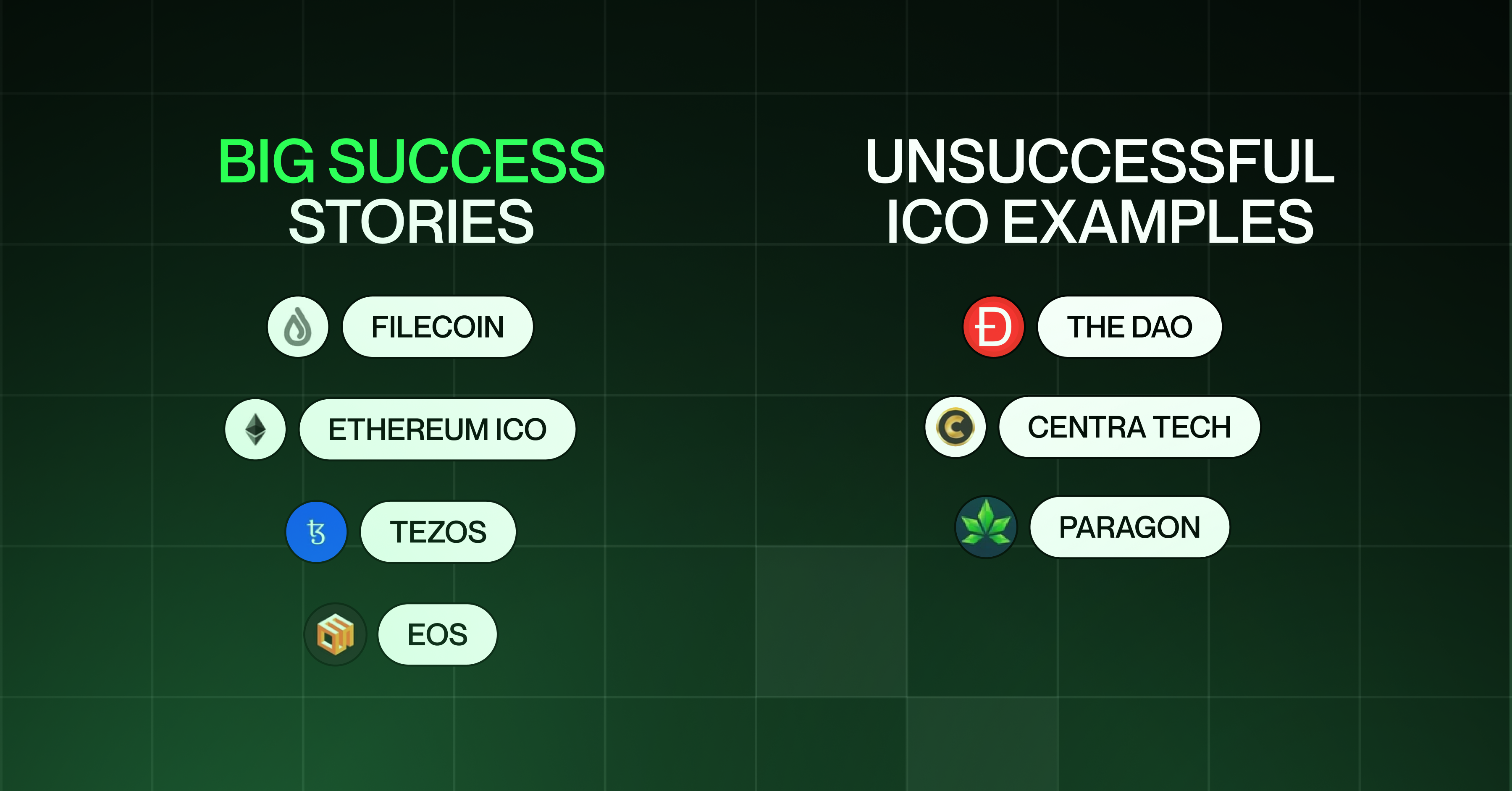

Big success stories

- Ethereum ICO. The project received $18 million and laid the foundation for an ecosystem of smart contracts.

- Filecoin. The creators managed to collect $257 million, and then the project became a base for storing data.

- Tezos. The project attracted $232 million; in this case, there were also problems with management, but the project is alive;

- EOS. The team was able to collect investments for more than $4 billion, although the results caused mixed reviews from investors.

Unsuccessful ICO examples

- The DAO. First major failure: After raising $150 million in Ether, the project's smart contract was hacked, causing an Ethereum hard fork and reputational damage to the DAO approach;

- Centra Tech. Marketing with fake partnerships and celebrity endorsements didn't save the day: the founders were arrested for fraud. One of the biggest scams of the ICO era;

- Paragon. The project positioned itself as a blockchain for the cannabis industry, raised $70 million, but failed due to poor implementation and lack of a real product.

ICO vs Other Crypto Fundraising Models

Today, ICO finance is just one way to raise funds. It has been replaced by more regulated or technically advanced formats: IEO, STO, NFT rounds, and DeFi fundraising. To understand the difference, below is a brief comparison of these models.

| Model | Features |

|---|---|

| ICO | Decentralized, flexible, accessible method – ideal for startups and individuals. |

| IEO | Organizes token sale through the exchange, increases trust and liquidity, but frequent decentralization is lost. |

| STO | Focus on regulatory requirements, reducing investor risks, but requires complex infrastructure. |

| NFT/DeFi Pilots | Innovative approaches – tokens are used as rights to unique assets or shares of a liquidity pool, but do not always provide utility. |

If you want to invest in crypto ICO without unnecessary risks and with a future perspective, participate in Nexchain crypto presales today.

Conclusion

Initial coin offerings ICOs remain a significant financial instrument of Web3, even 9 years after their appearance. Today, ICOs are not fundraising, but a real test of projects for transparency, fairness, and technological maturity.

Learn to analyze whitepapers, monitor cryptocurrency, evaluate the team and tokenomics, and only then enter ICO investment. Especially against the backdrop of the development of AI-powered token economy, where fairness and utility are becoming key metrics.

Nexchain is a project that meets modern trends: AI protection, scalability, staking, and community. If you are looking for investing in an ICO, where technology and infrastructure coincide, check out its model, listing, and tokenomics right now. Invest wisely – and get access to the Web3 infrastructure of the future.

FAQs About Initial Coin Offering (ICO)

What is the ICO?

ICO is a mechanism where a startup issues tokens (coins) in exchange for investments.

What is the full form of ICO?

The acronym ICO stands for Initial Coin Offering.

What is an initial coin offering?

This is the process of initial token offering – a form of crowdfunding that is focused on decentralized projects.