According to Investopedia, since the beginning of initial coin offerings (ICOs) in 2013, about 80% of them turned out to be scams. 2017 was especially “rich” in such projects – they emerged and disappeared, due to the dishonesty of the team, poor marketing, impractical concept, insufficient funding, or something else. As a result, those who were inspired by the success of early investors in BTC and ETH lost their money.

However, the crypto market changed, and in 2025, the approach of project teams to crypto coin ICOs has transformed in a positive direction. Below, we will explain how risky this crowdfunding model is for investors and whether it is worth participating in ICO blockchain events at all.

Why Invest in ICOs?

Statistics of coin ICOs are depressing, so why do they still attract investors' attention? The answer is simple. Investors participating in ICOs show their interest in a new project to profit from the resale of its tokens in the near future (when their price on the external market rises). Many of them also expect to use the services of this project at a low cost. Finally, it is worth noting that adding cryptocurrency tokens to an investment portfolio can reduce the risks associated with traditional financial tools.

The downside of this approach to investing is that the cryptocurrency market is not yet properly controlled, and legal authorities will not be able to protect the injured investor if something bad happens. Also, investors of coin ICOs are not guaranteed to get a profit – simply because the project may not appeal to its audience and fail.

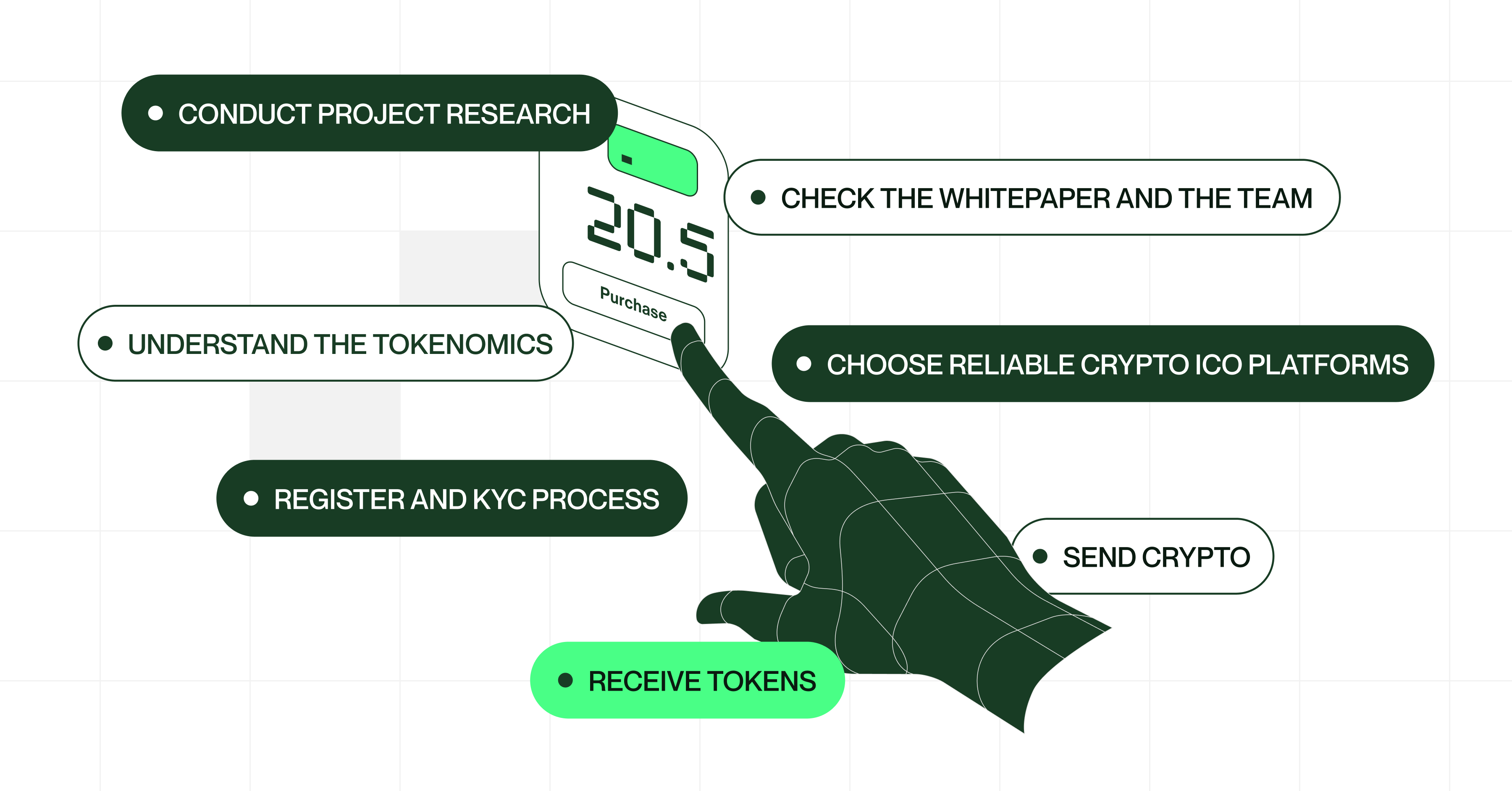

How to Buy an ICO: Step-by-Step Guide

Although ICO investments are still high-risk, they can also provide multiple returns on invested money in just a year or two. That is why, to minimize the possibility of your losses, it is important not only to know how to buy ICO but also to understand how to analyze the project, participate in its crowdfunding event, and store your crypto assets.

1. Conduct project research

Before buying an ICO, you should analyze the project in detail, namely, find out what problems it solves, what its mission is, who its target audience is, and whether it has more promising competitors. It also makes sense to check whether the project has a working MVP ready, whether its source code is open on GitHub, what the project's rating on aggregators (for example, on ICO Drops and ICOBench) is, and how active the discussions of the project on forums and social networks are (or maybe they look fake).

2. Check the whitepaper and the team

A whitepaper is a document that describes all the technical and non-technical details of a project, including its concept, tokenomics, blockchain architecture, and security mechanisms. The things you should pay attention to are a transparent and realistic roadmap, the terms of participation in the ICO (soft/hard cap, schedule, etc.), and legal aspects. Additionally, before ICO buying, you will need to analyze the LinkedIn profiles of the project team to assess their experience in the blockchain or IT niche and also make sure that the project already has large investors or well-known consultants.

3. Understand the tokenomics

Tokenomics defines how and why the token will be used, and how it will be distributed (i.e. how many tokens will be in circulation, how many will go to the team and investors, and whether there are locks for the team). You should also find out how the token participates in the project economy (it can be utility, governance, or payment). In general, the more balanced and transparent the distribution, the higher the chances that the token price will not collapse after the full-fledged project launch.

4. Choose reliable crypto ICO platforms

Many ICOs of cryptocurrency undergo audits on specialized platforms (launchpads), such as Binance Launchpad, Coinlist, DAO Maker, Polkastarter, TrustSwap, etc. In particular, they analyze the project's program code and its team. Thus, with such an audit, you will receive additional guarantees of the project's reliability and legal transparency of the deal.

5. Register and KYC process

Most legal tokens ICOs require identity verification using KYC. To do this, you need to register on the platform where the ICO coin offering is taking place, upload your documents (usually, this is a photo of your passport or driver's license), confirm your address, and, in some cases, undergo video or email verification. It is also worth knowing that residents of the USA, China, and some other countries cannot participate in ICOs due to legal restrictions. Therefore, always check the legality of your intentions before registering.

6. Send crypto (usually ETH or USDT)

Almost all ICO offerings allow you to buy tokens in ETH or USDT (although sometimes, you can also do this in BNB or BTC). After passing KYC verification, you will receive a smart contract address where you need to send funds. However, be careful: do not send cryptocurrency until you receive precise instructions from an official project source.

7. Receive tokens

After the ICO offering round is completed, you will receive tokens automatically in your crypto wallet, or this will happen through the activation of a claim on the project website (for this, you have to connect your crypto wallet). It is important to note that some projects have a temporary lock or unlock ICOs coins in parts (this is called vesting), so you will need to clarify this information if your strategy is short-term.

Would you like to become an early investor in the ICOs cryptocurrency? So far, the NEX price is even lower than during the ICO, which will take place after the team reaches the soft cap.

Conclusion

Participating in token ICOs allows investors to buy tokens at the lowest cost and get an increase of 10x or more. However, this is also a risky step, so in order not to fall into the trap of scammers, you need to complete the following steps:

- Analyze the project and its use cases;

- Check the whitepaper and the project team;

- Evaluate the fairness and transparency of tokenomics;

- Choose a reliable platform where the project token is listed and determine the amount of money you are willing to risk.

In general, if you make your ICO purchase consciously and diversify your crypto portfolio (allocating no more than 10-15% of the total investment to each cryptocurrency), you will have a good chance of getting the coveted X's pretty quickly.

FAQs About Buying ICOs

What is an ICO, and how does it work?

The answer to this question can be found in our article “What is an ICO in cryptocurrency and how does it work?”

How do you buy ICO?

You buy ICO tokens by sending ETH or USDT to the project's smart contract address (usually this feature becomes available after you pass the platform’s KYC). Once the transaction is completed, you receive the project's tokens, either immediately or after the ICO campaign ends.

Is ICO the same as a token sale?

No, an ICO offering is just one type of token sale. Other types of token sales include IEO (when listing takes place on centralized exchanges), IDO (with listing of tokens is conducted on decentralized exchanges), and STO (when a crypto project sells tokens that are tied to securities).

Are ICOs legal in the US?

You will find the answer in our article about the legal status of cryptocurrencies ICOs in the USA.

How to evaluate an ICO before buying?

The complete ICO blockchain checklist is presented in this article.

Where to find legit ICOs?

You can find the list of platforms where you can buy ICOs coins and the criteria for their assessment in this article.